HARRISON, AR (August 12, 2024) – It’s back to school time, which means parents are busy helping their children get back into learning mode. It’s also a great time to add a new lesson in their curriculum - one that will last a lifetime. Money management.

According to a 2024 WalletHub study, Arkansas ranked last in financial literacy. The study analyzed financial-education programs and consumer habits in each of the 50 states and the District of Columbia, ranking them based on three key dimensions: financial planning and habits, financial knowledge and education, and WalletHub’s proprietary WalletLiteracy Test score.

“Teaching children money management skills at an early age can help turn these trends around,” said Saely Wayland, business banker. “When children are taught the basics of budgeting, saving and spending wisely, they’re more likely to develop healthy, lifelong financial habits. Having these skills can help prevent financial mistakes that can lead to financial instability, low credit scores and lack of emergency savings.”

Wayland offers these tips to help parents talk to their children about money.

Start Teaching Money Lessons Early

It’s best to begin teaching money lessons when children are young. Because they learn mostly by observing, take them shopping and help them compare prices of products. Ask, “Which one costs less and saves us money?” Parents might also consider giving children a transparent piggy bank for capturing loose change so they can watch their savings grow.

Use Weekly Allowance to Teach Budgeting

When children are older, a weekly allowance can teach them how to be good stewards of their money, along with these principles:

● Identify “wants” vs. “needs.” When you spend freely, you’re not managing your money.

● Save, then spend. This helps avoid short- or long-term debt.

● Value working for money. When you earn your money, you think more carefully about spending.

● Comparison shop. Research saves money.

It won’t take long for the power of the purse to teach children to save before they spend. With age comes the ability to determine whether saving for the “next big thing” is worth skipping day-to-day purchases that bring short-term satisfaction.

Parents may consider giving their child compound interest by matching a small percentage of their child’s total savings each month to demonstrate how money saved can grow.

Lessons for College Students

If they haven’t learned by now, these young adults will see how quickly the little things add up. A great lesson for all college students is to look for money-saving and money-making options – everywhere.

● Online coupons, generic brand items, student discounts and generally living with less should be the norm until graduation.

● Earn some extra money by selling no-longer-needed items such as old textbooks or clothes.

● Babysitting, dog sitting or lawn work are other revenue options.

● Students who work a part-time job should set up direct deposits so that savings can be set aside first.

● Use cash to pay for items to help avoid creating debt, which can be a good reminder of how quickly money disappears.

● Don’t rely on credit cards unless it’s possible to pay off the monthly balance in full.

Spending mistakes are inevitable, but they can be good lessons. A commitment to save first, save early, save consistently and to track spending are among the best practices for developing healthy financial habits.

###

The above press release is from Arvest Bank.

Return to Cool Before Next Warm-Up

Return to Cool Before Next Warm-Up

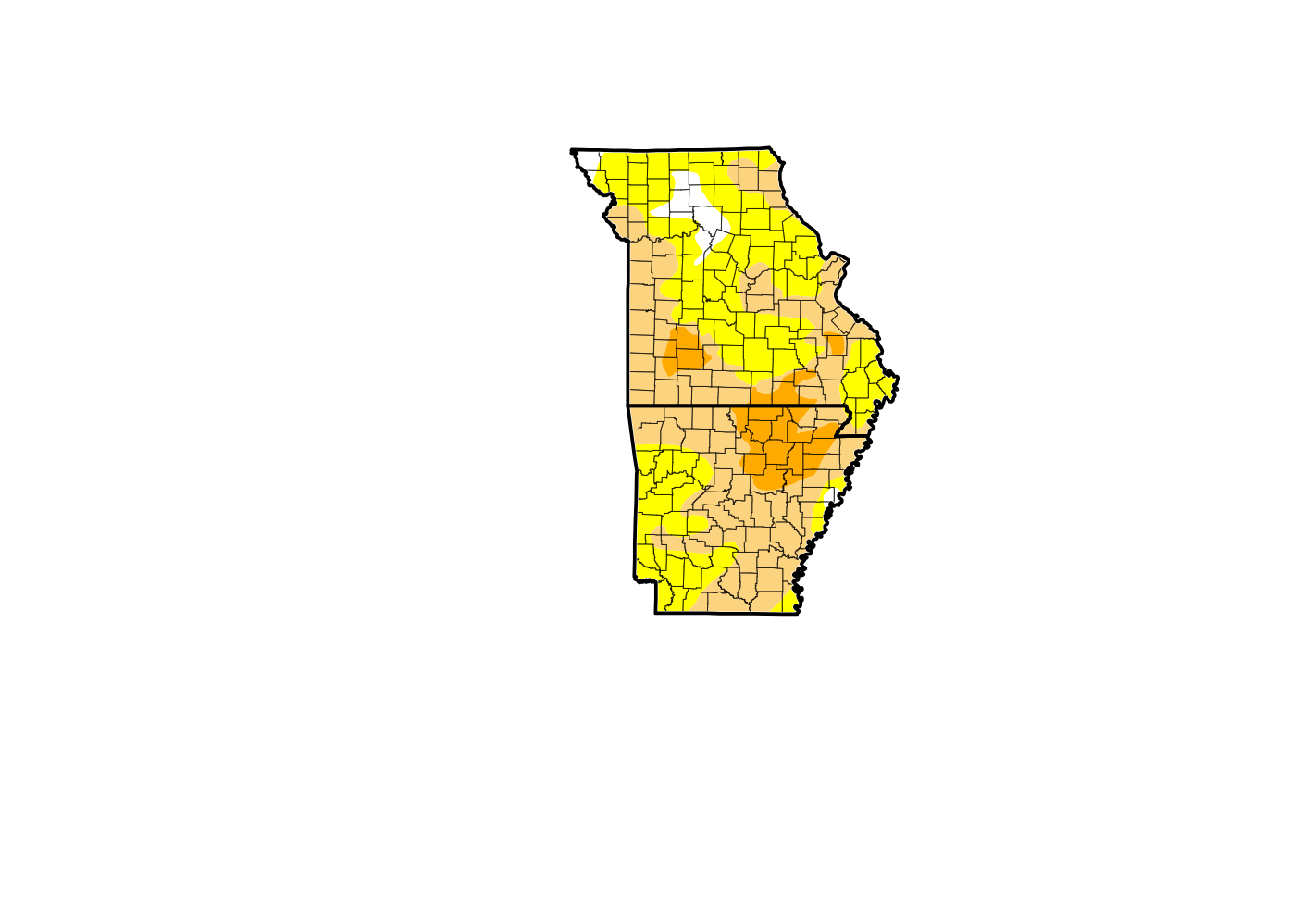

Drought Level Continues to Rise in Lakes Region

Drought Level Continues to Rise in Lakes Region

High School Student Aids Law Enforcement in Locating Missing Teen

High School Student Aids Law Enforcement in Locating Missing Teen