SPRINGFIELD, Mo. — Consumer debt continues to climb all across the United States, with Americans owing around $2.9 trillion just in credit card debt and auto loans. However, some states are struggling with debt more than others.

A study from WalletHub measured which states’ residents have seen the largest and smallest increases in consumer debt according to their data from Q3 2024 to Q4 2024, and both Missouri and Arkansas came out very well compared to the rest of the country.

According to the study, Missouri consumers had the fourth-smallest increase in debt in the U.S. with a total score of 36.08, while Arkansas came right behind with only the fifth-smallest increase with a 39.02 score. Only Montana (30.47), South Dakota (32.18) and Rhode Island (35.96) saw smaller increases in their consumer debt in the final quarter of 2024.

The full article is available at ozarksfirst.com.

(Story by Drew Tasset, ozarksfirst.com)

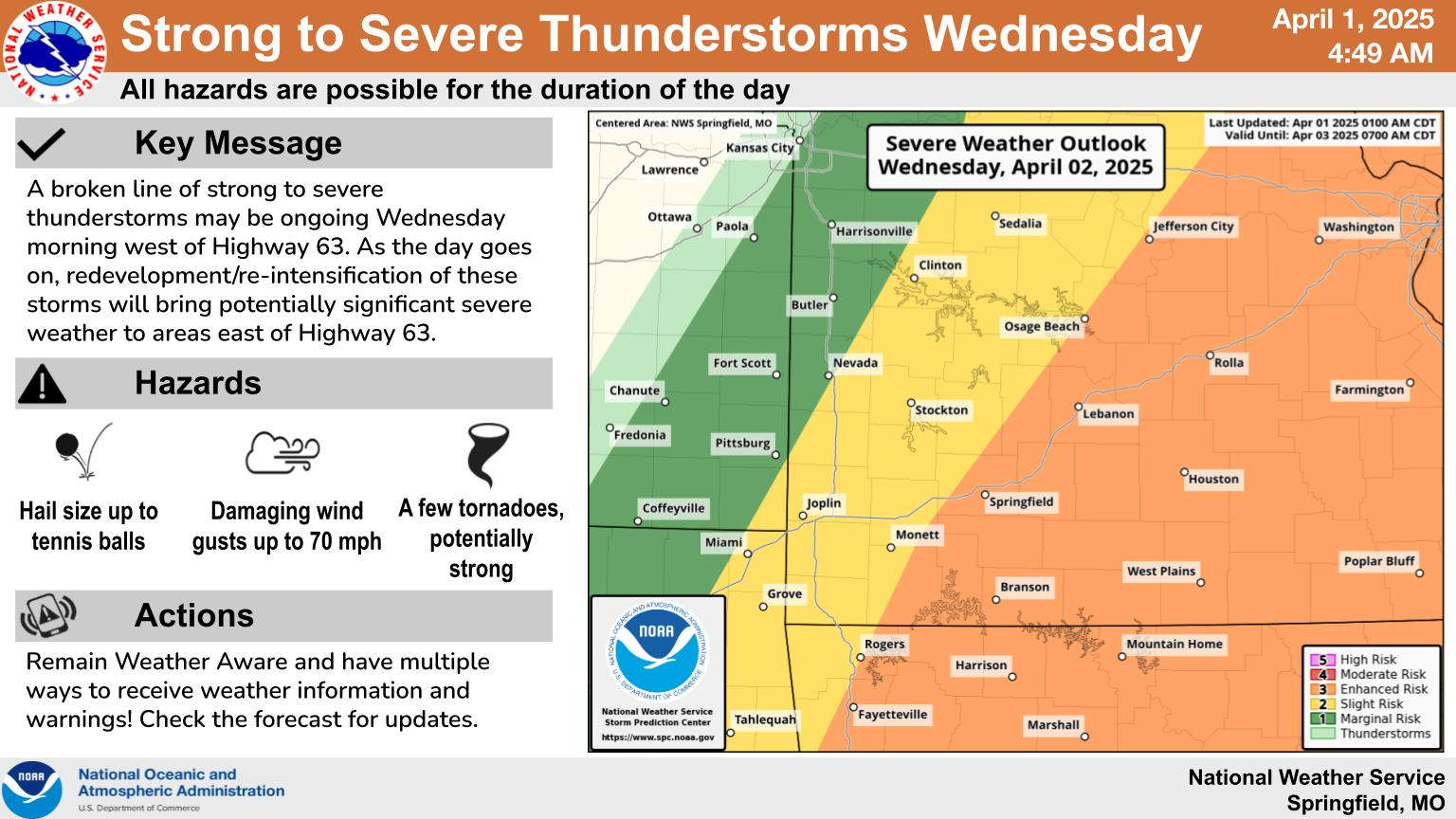

Severe Weather, Rain Chances Increasing

Severe Weather, Rain Chances Increasing

College of the Ozarks students experience new Global War on Terrorism Tour

College of the Ozarks students experience new Global War on Terrorism Tour

Downtown Branson Construction Set to Begin This Week

Downtown Branson Construction Set to Begin This Week

Branson School District 2025-2026 Kindergarten Registration

Branson School District 2025-2026 Kindergarten Registration

Silver Dollar City Launches New Festival – Spring Exposition

Silver Dollar City Launches New Festival – Spring Exposition