Time is ticking for Missouri drivers who hope to cash in on a new type of tax refund.

The story below by Heidi Schmidt, Ozarks First:

The gas tax on fuel sold in Missouri increased 2.5 cents in the past year. It is scheduled to increase annually even more over the next three years. By 2025, drivers will be paying nearly 30 cents a gallon more than in 2021 just because of the higher gas tax.

There is a way for Missourians to get some of that money back, but it’s going to take some effort.

Gather any gas receipts from stops at Missouri gas stations between October 2021 and June 2022.

Drivers are also required to complete the 4923-H form available on the Missouri Department of Revenue’s website. You will need the following information to complete the form:

- Vehicle’s VIN

- Date fuel was purchased

- Full address of the gas station where fuel was purchased

- The exact number of gallons of gas purchased

The completed form can be submitted through the Department of Revenue’s website, email it, or send it through the post office.

For that work, drivers will receive a $0.025 refund for every gallon of gas submitted and approved.

The form must be submitted, or postmarked, by Sept. 30, or it will be automatically rejected.

Drivers can learn more information about the motor fuel tax and refund claims online at the Department of Revenue.

If you hope to cash in the gas tax refund in the future, there’s an app that digitizes and tracks gas receipts that is available. It costs $4.99 for an annual subscription.

Eureka Springs, Flippin, Harrison Officers Among Those Honored by Arkansas AG

Eureka Springs, Flippin, Harrison Officers Among Those Honored by Arkansas AG

MSHP Works Three Crashes in Christian County

MSHP Works Three Crashes in Christian County

Jones Theatre Department performs preshow act for “PraiseFest Branson Christmas JOY!”

Jones Theatre Department performs preshow act for “PraiseFest Branson Christmas JOY!”

Elevated Fire Risk Today

Elevated Fire Risk Today

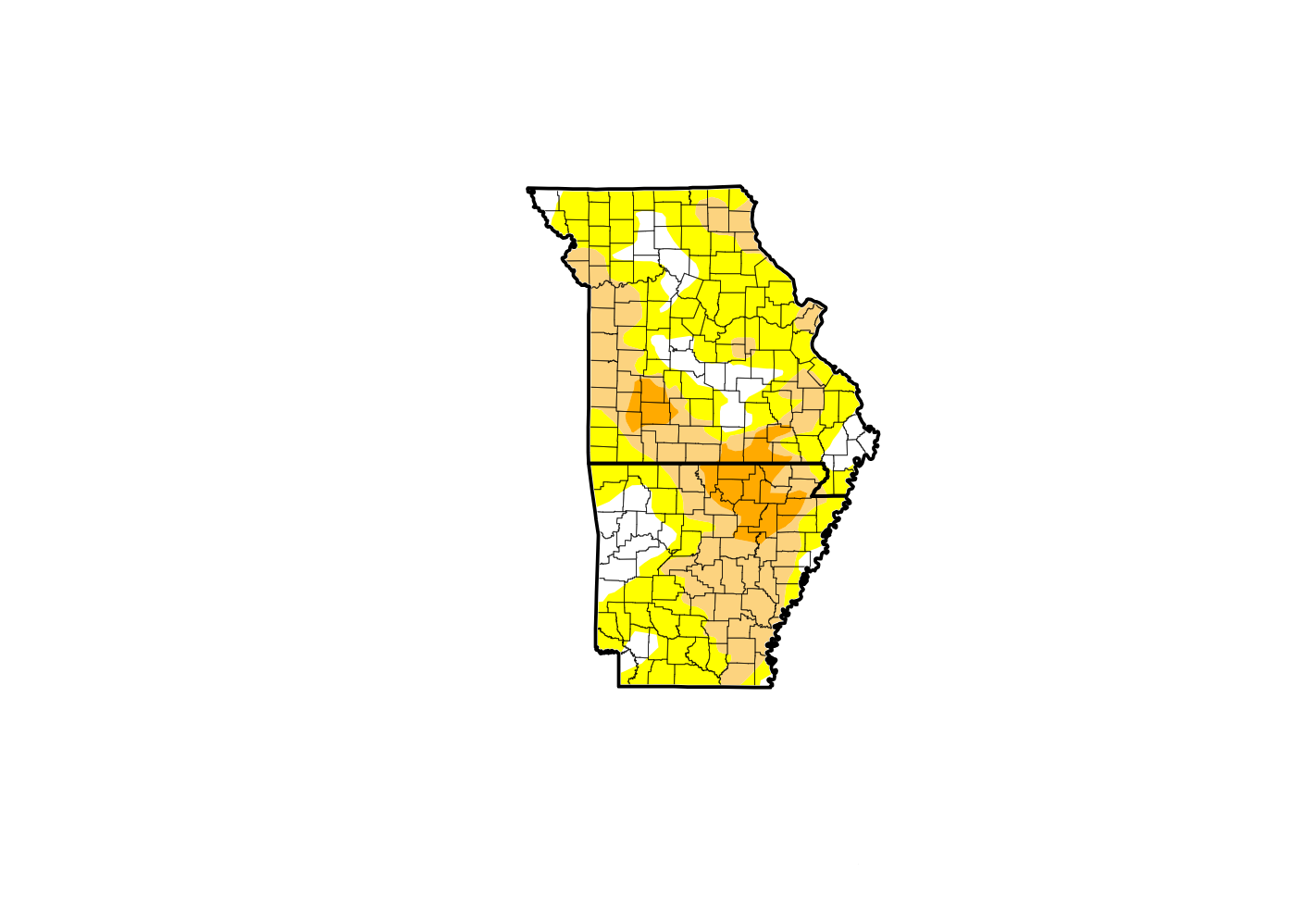

Drought Area Expands in Lakes Region

Drought Area Expands in Lakes Region